does georgia have estate or inheritance tax

Twelve states and Washington DC. So Georgians are only responsible for federally-mandated estate taxes in cases in which the deceased and.

Effective Rates Inheritance Tax In Usa 1995 Download Table

The good news is that georgia does not have an inheritance tax either.

. Two states match the federal exemption. Twelve states and the District of Columbia impose an estate tax while six states have an inheritance tax. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Maryland is the only state to impose both. Recently the estate tax law was changed so that a decedents estate tax exemption may be applied against lifetime gifts and after-death bequests by will or trust. Georgia does not assess and inheritance tax or a gift tax.

Washington states 20 percent rate is the highest estate tax rate in the nation. Georgia does not have an estate tax or an inheritance tax on its inheritance laws. If the decedent died on or before December 31 st 2004 his or her estate should have paid the taxes on the asset or assets before the distribution of the estate.

The good news is that Georgia does not have an inheritance tax either. Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. The lifetime exemption amount for a Georgia gift or estate is 15000 for each giver and recipient.

Georgia does not have any inheritance tax or estate tax for 2012. Maryland is the only state in the country to impose both. First there are the federal governments tax laws.

The exemption increases with inflation. Inheritance taxes are only in place in some states and Georgia is not one of them. It is not paid by the person inheriting the assets.

Very few people now have to pay these taxes. However other stipulations might mean youll still get taxed on an inheritance. No state estate or inheritance tax.

Impose estate taxes and six impose inheritance taxes. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206 million. The big question is if there are estate taxes or inheritance taxes in the state of Texas.

If you inherited assets from a deceased loved one you may wonder if you have to pay taxes on the property. Another states inheritance tax could still. If the value of a gift is less than the annual exclusion amount the gift is not subject to Georgia gift and estate taxes.

No Georgia does not have an inheritance tax. In this case 940000 would be subject to a Federal Estate Tax. Maryland and new jersey have both.

No Georgia does not have an inheritance tax. The estate tax exemption in 2021 is 11700000. However Georgia residents may still be on the hook for inheritance taxes if the state where.

You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022. The Georgia gift and estate tax is an annual tax on transfers of property that do not receive the full value in return. The tax is paid by the estate before any assets are distributed to heirs.

Whether youre an executor newly in charge of handling a complex estate left by a business owner or youre a family member concerned about losing an unnecessary amount of your inheritance to Georgia and federal estate taxes you probably have many questions about what to do. Suppose the deceased Georgia resident left their heir a 13 million worth of an estate. Eight states and DC are next with a top rate of 16 percent.

Technically speaking there is no federal inheritance tax but there is a federal estate tax. As of 2014 Georgia does not have an estate tax either. There are not any estate or inheritance taxes in the state of Texas.

Citizen may exempt this amount from estate taxation on assets in their taxable estate. Understanding Georgia inheritance tax laws and rules can be overwhelming. Does Georgia Have an Inheritance Tax.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. Seventeen states have estate taxes but Georgia is not one of those either. The estates personal representative or executor is responsible for filing the necessary documents with the Internal Revenue Service IRS and for paying any tax that might be owed.

Georgias estate tax is based on the amount allowable as a credit for state death taxes on the federal estate tax return Form 706. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Inheritance taxes also known as estate taxes are the taxes paid on the property left to the heirs of a deceased person.

The short answer is no. Only 11 states do have one enacted. Estate taxes also called inheritance taxes are the taxes paid on the assets left to the family of a deceased person.

The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in.

401 K Inheritance Tax Rules Estate Planning

Inheritance Tax In The Uk Offshore Citizen

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Is Your Inheritance Considered Taxable Income H R Block

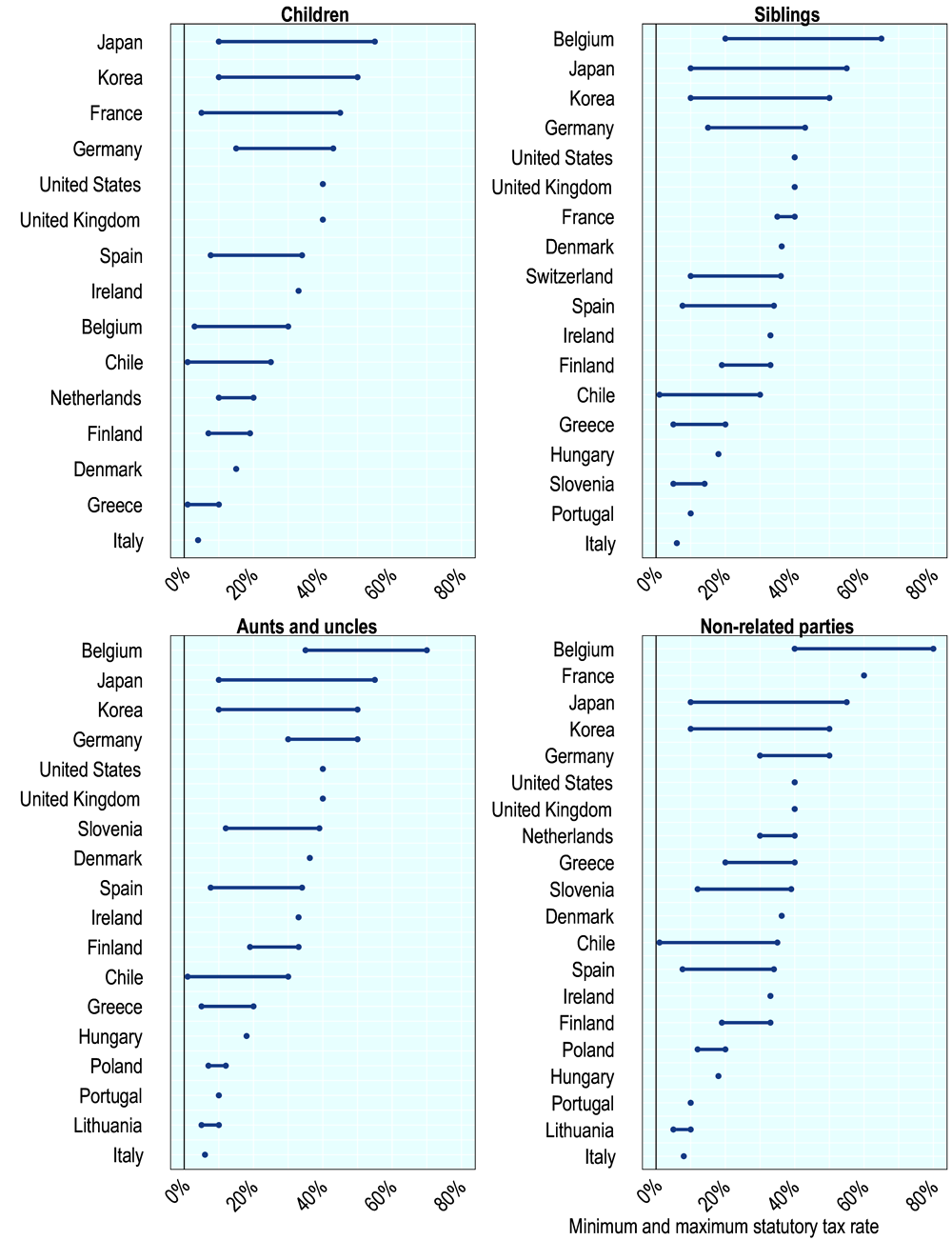

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia Estate Tax Everything You Need To Know Smartasset

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes Itep

What You Need To Know About Georgia Inheritance Tax

Do You Have To Pay Taxes On Inheritance All You Need To Know In 2022

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia Estate Tax Everything You Need To Know Smartasset

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington